New 1099 Rules 2024 Required – Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . Rather, it will keep the long-standing system in place of only requiring a 1099 for those What’s more, come 2024, the IRS is only going to phase in the new reporting requirements. .

New 1099 Rules 2024 Required

Source : www.pbmares.comIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com1099 Rules for Business Owners in 2024 Mark J. Kohler

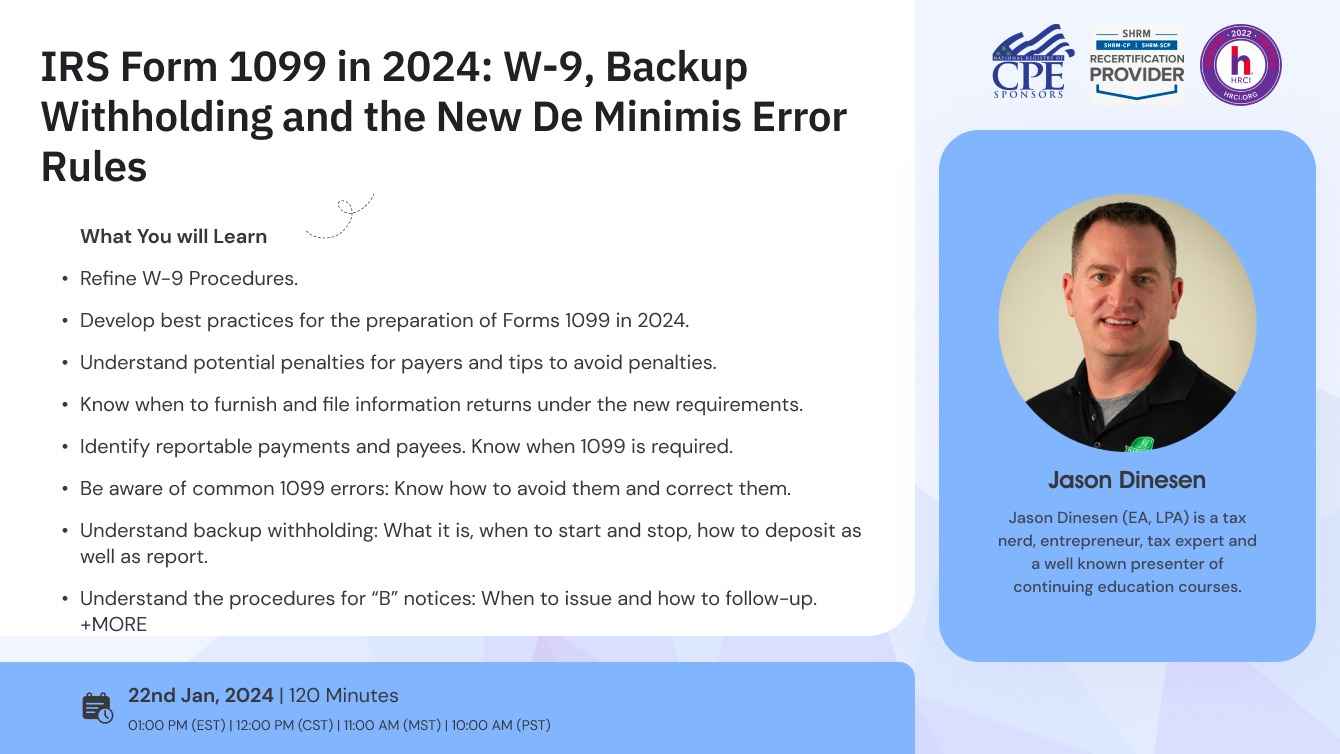

Source : markjkohler.comIRS Form 1099 in 2024: W 9, Backup Withholding and the New De

Source : clatid.io2024 Guide: Essential 1099 Filing Insights & Requirements

Source : www.katzabosch.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.comLVBW LLP Accountants & Consultants | Amherst NY

Source : www.facebook.comNew tax rules coming for those using mobile payment apps MSU

Source : red.msudenver.eduNew 1099 Rules 2024 Required 1099 K Reporting Requirement Delayed for 2023; New, Phased In : Freelancers shouldn’t expect 1099-Ks this tax season. But you still need to report any self-employment income to the IRS. . The proposed regulation would require the reporting of information about non-financed residential real estate sales to legal entities, trusts, and shell companies. .

]]>